Nancy Lottridge Anderson, Ph.D., CFA, and her staff offer expert advice and personal service. We offer our services on an hourly or retainer basis for our clients. Our services include account management, stock and economic research, retirement planning, and 401k slate analysis. We manage investment accounts of any size and tailor the portfolio to meet your specific needs. For clients of ours, we are available to help with any financial situation you face.

Independent, Fee-Only Financial Advisor

Wednesday, May 31, 2006

Is the Fed Confused?

Minutes from the Federal Reserve's meeting today were not much help in determining whether a rates increase is in our immediate future or not. In fact, the Fed declared that, "Given the risks to growth and inflation, committee members were uncertain about how much, if any, further tightening would be needed." Chairman Bernanke left the door wide open for either an immediate increase, or a distant "tightening."

Despite these rather vague hints from the Fed, trading was up today. And although May has been more of a "sell" time, the month ended on a "buy" day. That put all three major U.S. markets in the green, and a green ending always helps me sleep!

DJIA: +73.88

Nasdaq: +14.14

S&P 500: +10.25

Tuesday, May 30, 2006

Its Official, We're Addicted

As Americans, we have once again proven our addition to gasoline. Despite rising oil prices, our eagerness for the open road hasn't lessened. Trading volume is up, and consumer demand far outweighs our country's production of crude oil.

Although our consumption of gasoline is as high as ever, retailers are wondering just where it is we're going - since its certainly not out shopping. Wal-Mart had a disappointing May sales report; consumers cut back on spending. But spending isn't the only place consumers are lacking. A New York reserach group said its monthly poll of consumer confidence slid to 103.2 in May, down from 109.8 in April. And although this was higher than expected, the effects hit the market hard. Let's keep our fingers crossed that the Fed will have something positive on Wednesday.

DJIA: -184.18

Nasdaq: -45.63

S&P 500: -20.32

Friday, May 26, 2006

Inflation Doesn't Scare Us!

A report came out today showing signs of inflation is nearing the edge of the Fed's comfort zone. The report said consumer spending was up in April, largely due to steady income growth. And yet, trading was up and treasury bonds were hardly affected. What inflation scare?

On the lazier side of things, we're "busy" getting ready for Memorial Day at my house. I'm checking out the best recipes and keeping an eye on the weather.

DJIA: +67.56

Nasdaq: +12.13

S&P 500: +7.28

Thursday, May 25, 2006

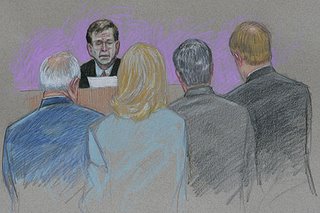

Upbeat Despite Enron Convictions

The Jury announced their verdicts for Enron's Skilling and Lay today - GUILTY. The trial, going on since Enron's collapse in 2001, has been a lengthy and hairy one. Sentencing is set for September 11. Many are voicing their opinions of the verdicts and what might happen next.

While some analysts were paying attention to the verdict, others were paying much closer attention to the internet - Yahoo and eBay, in particular. The two internet giants announced a partnership today, boosting sales. The GDP report was much higher than expected, and Regions Financial announced a $10 million merger with AmSouth. Add all these positive factors together, and you get one very green day. Thank goodness!

DJIA: +93.73

Nasdaq: +29.07

S&P 500: +14.31

The Jury announced their verdicts for Enron's Skilling and Lay today - GUILTY. The trial, going on since Enron's collapse in 2001, has been a lengthy and hairy one. Sentencing is set for September 11. Many are voicing their opinions of the verdicts and what might happen next.

While some analysts were paying attention to the verdict, others were paying much closer attention to the internet - Yahoo and eBay, in particular. The two internet giants announced a partnership today, boosting sales. The GDP report was much higher than expected, and Regions Financial announced a $10 million merger with AmSouth. Add all these positive factors together, and you get one very green day. Thank goodness!

DJIA: +93.73

Nasdaq: +29.07

S&P 500: +14.31

Wednesday, May 24, 2006

A Slow Recovery

Whew! Stocks were up today - thank goodness! After several days of a decline, there is relief in sight! Although traders are still nervous about the recent decline, the Dow still ended up almost 19 points by the end of the day. This recent decline with the markets has investors hoping that a rate increase is surely NOT in our immediate futures, as the Fed indicated earlier. And with rates no longer increasing, you may be thinking about buying, selling, or maybe even refinancing your home. If you are, check out what the current value of your home is, according to the most recent online tool.

And although we tend to panic when the markets are down, analysts point out that, if we use this time wisely, it may make us all smarter investors.

DJIA: +18.97

Nasdaq: +10.41

S&P 500: +1.99

Tuesday, May 23, 2006

"Tag! You're IT!"

The market this week reminds me of playing tag as a kid. Go as fast as you can. Turn, duck, squeal, stop, run again. After a dizzy day yesterday, stocks were up all day today. Analysts were trying to get traders to relax, and it seemed to be working...until about 3pm. Inflation is the major concern, and the gist of why the market has been in the red. But the housing market is cooling and energy prices seem to be ever-so-slowly falling. Relief!

And speaking of childhood, some analysts are comparing the global market to an old fable, Goldilocks. Guess what the three bears represent?!

DJIA: -26.98

Nasdaq: -14.10

S&P 500: -5.49

Monday, May 22, 2006

A Yo-Yo Day

First they were up. Then they were down. Then they were up again. Then they finished down. It was a yo-yo day on Wall Street, as investors tried to gauge the winds of inflation. Hurricane forecasters predicted another big year, but tempered that with "not as bad as last year." Thank goodness! Oil fell into the $67 range, but that didn't help. The Nervous Nellies are concerned about inflation heating up and other areas cooling down. Wal Mart decided to pull out of red hot South Korea. They can't compete. Go figure! NASDAQ was the biggest loser, dropping nearly 1% on the day. I'm just waiting for the bounce.

Dow -18.73

NASDAQ -21.02

S&P 500 -4.96

Friday, May 19, 2006

Friday!!

Markets turned up today. The Fed started making noises about keeping interest rates the same. This was enough to turn the day around. The Dow was in positive territory, but, percentage-wise, showed the weakest numbers. The broader S&P 500 and the tech-laden NASDAQ gained in the 1/2% range... a good sign. Investors expressed relief at the news.

I took a WSJ poll today. It asked if gas prices would affect my summer vacation plans. I said "no." I was in the majority. For all the talk of high fuel prices, the reality is that it doesn't seem to be causing a change in our behavior. I head to the airport tonight to pick up my daughter and her fiancee. I think this is her 4th flight home from NYC in about 4 months... hasn't stopped her. We'll drive to the beach next week for a little R&R... hasn't stopped us. Have a great weekend!

Dow +15.77 +0.14%

NASDAQ +13.56 +0.62%

S&P 500 +5.22 +0.41%

Thursday, May 18, 2006

STELLAAAAAH!

Another day for traders to head for the doors, as inflation worries hang over Wall Street. Across the board, stocks lost about 3/4%, adding to the slide started last week. While housing is slowing down, the new Fed chief is convinced the landing will be soft. Of course, everything hinges on the actions Mr. Bernanke and his cohorts take in the next couple of months. Innovators are still at work, though. Internet surfing is heading to the small screens of the cellphone. Alternative energy companies are still plugging away, and there's a new online dating service for Chinese people. Ahh, the wonders of the modern world. I'm still looking for opportunities, even as the naysayers are on the prowl.

Dow -77.32 -0.69%

NASDAQ -15.48 -0.70%

S&P 500 -8.51 -0.67%

STELLAAAAAH!

Another day for traders to head for the doors, as inflation worries hang over Wall Street. Across the board, stocks lost about 3/4%, adding to the slide started last week. While housing is slowing down, the new Fed chief is convinced the landing will be soft. Of course, everything hinges on the actions Mr. Bernanke and his cohorts take in the next couple of months. Innovators are still at work, though. Internet surfing is heading to the small screens of the cellphone. Alternative energy companies are still plugging away, and there's a new online dating service for Chinese people. Ahh, the wonders of the modern world. I'm still looking for opportunities, even as the naysayers are on the prowl.

Dow -77.32 -0.69%

NASDAQ -15.48 -0.70%

S&P 500 -8.51 -0.67%

Wednesday, May 17, 2006

A Chicken Little Day

Markets didn't just dip or slip. They dove for cover after news on consumer prices indicated inflation may be rearing its ugly head. Just yesterday, economists were declaring that rates would not be raised again for another year. Today, they're all declaring the Fed will crank up again. Even the famous bond investor, Bill Gross, is changing his tune about rates. Yes, prices are rising, but it's up to Mr. Bernanke and his crew to decide if the latest news is enough to warrant an official action. They raised rates just a few weeks ago. Personally, I think Wall Street is overreacting. While some investors are heading for the doors, I'm diving IN. After all, I love a good sale!

Dow -214.28 -1.88%

NASDAQ -33.33 -1.55%

S&P 500 -21.76 -1.68%

Tuesday, May 16, 2006

Gasoline Excuses and Plays

Markets tipped back into negative territory, even on the big-cap side. Wal Mart's earnings looked good, but they're whining about sales going forward. The culprit? Gasoline prices. They claim their customers are shutting their pocketbooks, but I don't buy it. I think customers are just heading more upstream, and that's good news for the entire economy. Buffett announced his acquisition of a large piece of ConocoPhillips, so the gasoline situation is good news for Berkshire Hathaway. Tech has been sliding a good bit lately, but HP released stellar earnings after the close. Let's hope for a bounce in this sector tomorrow.

Dow -8.56

NASDAQ -9.39

S&P 500 -2.42

Monday, May 15, 2006

A Monday Bounce

Large caps took a break from the slide, as the Dow and the S&P 500 headed into positive territory today. NASDAQ is still on the red side, dipping a slight 1/4%. The end of last week sent many investors scurrying. The first of the year was just too good. You knew it had to happen... the two steps back. Despite this, markets are poised for more growth. Business is changing and growing each day. NBC is moving from network TV to web-based TV. Advertising is quickly changing, too. What will be next?

Dow +47.78

NASDAQ -5.26

S&P 500 +3.26

Friday, May 12, 2006

Inflation Strikes Again

The Dow sank 1.3% today, a continued effect of the rates increase by the Fed on Wednesday. The Dow was just 80 points shy of topping its record when it was derailed by traders, nervous at the prospects of inflation and interest rates. And we have a variety of causes to thank for inflation, high oil and gold prices to name a few.

But not all the experts think inflation is out of control. Patrick Fearon, an economist at A.G. Edwards & Sons, expects inflation to slow down in the next few months. That would also mean no more increases from the Federal Reserve, and that's good news to end the week!

DJIA: -119.74

Nasdaq: -28.92

S&P 500: -14.68

Thursday, May 11, 2006

Delayed Reaction from Wall Street

Hopes were high yesterday when the market was actually UP after the Fed announced rates were going up, an unusual outcome. And it was the bright spot in my very cloudy (and rainy) day. Apparently, investors were waiting for a beautiful day to hit hard. Traders scattered today and stocks retr eated in what some specialists call a "delayed reation" to the Fed's announcement of raising rates.

Fortunately, those same experts claim we're in the middle of a good, old-fashioned economic boom as we continue to rebound from Hurricane Katrina. The Dow has been within sight of its record for weeks now, and corporate profits have had an 11-quarter streak of double-digit gains. This kind of economic boom hasn't been seen since after WWII, and I'd like to be the first to offer a hearty, "Welcome Back!"

DJIA: -141.92

Nasdaq: -48.04

S&P 500: -16.93

eated in what some specialists call a "delayed reation" to the Fed's announcement of raising rates.

Fortunately, those same experts claim we're in the middle of a good, old-fashioned economic boom as we continue to rebound from Hurricane Katrina. The Dow has been within sight of its record for weeks now, and corporate profits have had an 11-quarter streak of double-digit gains. This kind of economic boom hasn't been seen since after WWII, and I'd like to be the first to offer a hearty, "Welcome Back!"

DJIA: -141.92

Nasdaq: -48.04

S&P 500: -16.93

eated in what some specialists call a "delayed reation" to the Fed's announcement of raising rates.

Fortunately, those same experts claim we're in the middle of a good, old-fashioned economic boom as we continue to rebound from Hurricane Katrina. The Dow has been within sight of its record for weeks now, and corporate profits have had an 11-quarter streak of double-digit gains. This kind of economic boom hasn't been seen since after WWII, and I'd like to be the first to offer a hearty, "Welcome Back!"

DJIA: -141.92

Nasdaq: -48.04

S&P 500: -16.93

eated in what some specialists call a "delayed reation" to the Fed's announcement of raising rates.

Fortunately, those same experts claim we're in the middle of a good, old-fashioned economic boom as we continue to rebound from Hurricane Katrina. The Dow has been within sight of its record for weeks now, and corporate profits have had an 11-quarter streak of double-digit gains. This kind of economic boom hasn't been seen since after WWII, and I'd like to be the first to offer a hearty, "Welcome Back!"

DJIA: -141.92

Nasdaq: -48.04

S&P 500: -16.93

Wednesday, May 10, 2006

A Gloomy Day

The weather here has been very gloomy. I've had to make two pots of coffee to keep me from getting as drowsy as the weather!

The Fed announced another rate increase today; its now up to 5%. After this announcement, trading spiralled downward, but then crawled back up at the end of the day. The Dow ended slightly up (.02%), but the Nasdaq finished the day down. Investors remain optimistic about the future, despite the Feds warnings that future "policy firming" may yet be in store.

DJIA: +2.88

Nasdaq: -17.51

S&P 500: -2.29

Tuesday, May 09, 2006

"And the Last Shall Be First..."

The Dow was up more than 50 points today, thanks to a company that has long been the dragging wieght of the market. General Motors gained nearly 10% today after regulators let it revise the way it accounted for a health-care deal last year. The deal flipped a first quarter loss to a $445 million profit. Now there's a flip you don't mind seeing!

DJIA: +55.23

Nasdaq: -6.74

S&P 500: +0.48

Monday, May 08, 2006

Caution Signs Everywhere

I can't drive a mile down Highland Colony Parkway without running into some sort of construction. And with every construction site comes orange cones and caution signs. Its a sign of growth and business, I know, but it somehow doesn't stop me from occasionally losing my patience.

Wall Street also saw big caution signs today. As investors prepared for Wednesday's Fed meeting, trading slowed and volume was thin. But a baby step up is still a step up, no matter how small.

DJIA: +6.80

Nasdaq: +2.42

S&P 500: -1.10

Friday, May 05, 2006

When Mr. Buffett talks...

The Berkshire Hathaway annual meeting is coming up, and the word is that Mr. Buffett is poised for a big announcement. He's been sitting on a large amount of cash and now appears ready to buy. This was enough to send markets into the stratosphere! The Dow picked up more than 1% on the day, while NASDAQ gained in the 3/4% range. Oh, yeah, and oil dipped a bit, but who's really paying attention to that? Stay tuned for the BRK purchase announcement!

Dow +138.88

NASDAQ +18.67

S&P 500 +13.51

Thursday, May 04, 2006

A Shopping Day

Markets gained today, as retail numbers came in. After sky-high oil prices, who would have thought it would be the retail sector holding things up? I thought we were putting all our money in the tank, but SOMEONE is buying. The Dow is getting close to its all-time high. We'll be on market watch for that magical number. In the meantime, I'm going shopping!

Dow +38.58

NADAQ +19.93

S&P 500 +4.40

Wednesday, May 03, 2006

An Oil Dip

Oil dropped... a LITTLE. We're still in the 70s range, and the buzz is all about summertime gas prices. GM execs claim we are still not changing our behavior, but GM is changing its behavior. The company is scaling back. Judging by the number of cars and SUVs on the road, I don't see a behavioral change. We're still blowing and going. Markets dipped... a LITTLE. Time Warner and Proctor & Gamble posted good earnings, but Wall Street yawned.

Dow -16.17

NASDAQ -5.87

S&P 500 -5.36

Tuesday, May 02, 2006

Auto Industry...Climbs?

Despite climbing gas prices and fears of rate increases, the market was up today. The reason? High sales reports brought in by several auto companies. GM led the way, climbing 2.5% after posting its monthly auto sales.

Researchers say the confidence boost that first quarter earnings are better than expected is the real cause of this stock climb. And its no surprise that the energy sector leads the way, up 76% from a year ago.

DJIA: +73.16

Nasdaq: +5.05

S&P 500: +8.02

Monday, May 01, 2006

May Day Fizzle

Markets started well on this first of May but lost their steam, as rumors of higher interest rates swirled. The Fed and its new Chairman appear poised for another rate hike this month. While gas prices eased somewhat, the possible rate hike took its toll. NASDAQ took the biggest dip.

We Americans love our cars, but we may not actually like to drive. Try adaptive cruise control. It's available on some luxury cars and allows owners to coast while the autopilot does all the work. And if you want to personalize your car, call Turtle Transit. They'll turn your ordinary sedan into something unique. So, who's actually worried about the high price of gasoline?

Dow -25.29

NASDAQ -18.37

S&P 500 -5.30

Subscribe to:

Comments (Atom)