Nancy Lottridge Anderson, Ph.D., CFA, and her staff offer expert advice and personal service. We offer our services on an hourly or retainer basis for our clients. Our services include account management, stock and economic research, retirement planning, and 401k slate analysis. We manage investment accounts of any size and tailor the portfolio to meet your specific needs. For clients of ours, we are available to help with any financial situation you face.

Independent, Fee-Only Financial Advisor

Friday, June 30, 2006

By the Hair on My Chinny-chin-chin!

We almost ended the month on a good note. About an hour before close, the Dow was up more than 20 points, but trading in that last hour proved that investors are still a little concerned about inflation. The market ended down by the skin of its teeth!

The good news is, despite yesterday's rate increase, all the market averages are up for this month. The blue-chip average is up about 0.8%, the S&P 500's index is up more than two points, and the Nasdaq's index is up more than four points. What a relief to end this roller-coaster month on a few good notes!

DJIA: -40.58

Nasdaq: -2.29

S&P 500: -2.66

Thursday, June 29, 2006

Doves are Pretty

I like doves much more than hawks. And in "market talk," a "dovish" statement means just as it sounds - less agressive, less scary - less hawkish. Traders have been anticipating today's Fed statement for weeks, and the outcome was just that. Although the rates were raised a quarter of a point to 5.25%, the statement made was "dovish." The overtones in the Fed's speech sent stocks soaring, with the Nasdaq gaining almost 3%, and the Dow up almost 2%.

And this just in: EMC has agreed to buy RSA Security in a deal worth more than $2.1 billion. Those mergers keep rolling in!

DJIA: +217.24

Nasdaq: +62.54

S&P 500: +26.87

Wednesday, June 28, 2006

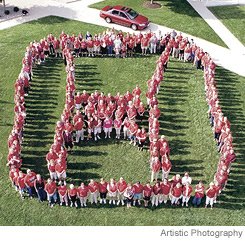

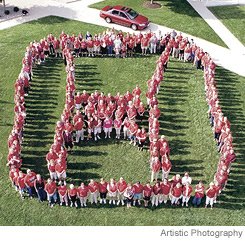

New Honda Plant

Stocks showed almost no movement this morning, but popped up late in the afternoon, bringing the Dow up almost half a point to 10973.56. This was caused by sudden activity in the energy department.

The Japanese auto-maker Honda, announced today the new location for its plant - in Greensburg, Indiana. A senior executive of Honda said the plant  will begin producing vehicles in 2008 and will hire 2,000 employees. How are the residents of Greensburg reacting? After years of animosity towards Honda (GM was a major employer in Indiana), the people of Greensburg have changed their minds. Residents have even gone as far as inviting a Japanese businessman to educate them on Japanese culture!

DJIA: +48.82

Nasdaq: +11.59

S&P 500: +6.80

will begin producing vehicles in 2008 and will hire 2,000 employees. How are the residents of Greensburg reacting? After years of animosity towards Honda (GM was a major employer in Indiana), the people of Greensburg have changed their minds. Residents have even gone as far as inviting a Japanese businessman to educate them on Japanese culture!

DJIA: +48.82

Nasdaq: +11.59

S&P 500: +6.80

will begin producing vehicles in 2008 and will hire 2,000 employees. How are the residents of Greensburg reacting? After years of animosity towards Honda (GM was a major employer in Indiana), the people of Greensburg have changed their minds. Residents have even gone as far as inviting a Japanese businessman to educate them on Japanese culture!

DJIA: +48.82

Nasdaq: +11.59

S&P 500: +6.80

will begin producing vehicles in 2008 and will hire 2,000 employees. How are the residents of Greensburg reacting? After years of animosity towards Honda (GM was a major employer in Indiana), the people of Greensburg have changed their minds. Residents have even gone as far as inviting a Japanese businessman to educate them on Japanese culture!

DJIA: +48.82

Nasdaq: +11.59

S&P 500: +6.80

Tuesday, June 27, 2006

Confidence Cometh Before a Fall

Consumer confidence reports were released today and were much higher than expected. This sent the market whirling as investors grew more certain of a rates increase at tomorrow's Fed meeting. A stronger-than-expected housing report added to the flurry of activity today.

Speaking of activity, a wave of multi-million dollar deals is quickly making 2006 the Year of Mergers. Companies such as Johnson & Johnson, Pfizer, Phelps Dodge Corp, and Inco Ltd. will add to the 2006 acquisitions parade, growing stronger every hour. According to Thomson Financial, 2006 is on its way to a year-end tally of over $3.5 trillion!

DJIA: -120.54

Nasdaq: -33.42

S&P 500: -11.36

Monday, June 26, 2006

Buffett is the Man

Warren Buffett announced today that the bulk of his Berkshire Hathaway stock will be given to the Bill Gates Foundation. An annual contribution of $1.5 billion from Mr. Buffett's stock will be put to use seeking cures for some of the world's worst diseases and to improve education in the U.S. I've met Mr. Buffett (see Bus Ride), and the media can never do justice to both his intelligence and compassion.

And investors seemed to overlook the upcoming Fed meeting today, as good news about the housing market and high merger activity bumped the Dow up more than half a point.

DJIA: +56.19

Nasdaq: +12.20

S&P 500: +6.06

Friday, June 23, 2006

Mergers Schmergers

Trading was effected today by the announcement that the oil and gas driller Anadarko Petroleum is buying its rivals Kerr-McGee and Western Gas Resources for over $21 billion. As investors weighed the effects of the energy merger, trading dipped. Although trading was up earlier today, it ended slightly down by close, a decline that is NOT expected to last, according to U.S. Market Strategist, Marc Pado. That sounds like a welcome opinion as we're heading into the weekend. Be safe and watch those gas prices!

DJIA: -30.02

Nasdaq: -1.51

S&P 500: -1.10

Thursday, June 22, 2006

Two Step

Another back and forth, give and take, day on Wall Street. Stocks retreated, as interest rates began rising. Mortgage rates hit a four year high, but they're still low, by historic measures. Frankly, I've been eyeing the yield curve, and I believe this bump up on the long end is overdue. The curve has been flat, flat, flat... even threatening to invert. This latest move should bring it back to a normal shape.

Dow -60.35

NASDAQ -18.22

S&P 500 -6.60

Wednesday, June 21, 2006

Small-caps and Stocks Surge

Small-cap funds surged, helping the Nasdaq gain 1.6% today. Investors hope this is the end of a slump that has caused many to panic. The gain in the market is largely due to positive earnings reports that were released today, particularly those reports from FedEx and Morgan Stanley.

And in an effort to rebuild, Ford revealed their 2007 lineup of new models. Ford hopes to attract numerous new customers in the ever-growing competitive auto industry.

DJIA: +104.62

Nasdaq: +34.14

S&P 500: +12.08

Tuesday, June 20, 2006

A Fair to Middling Day

Most of the trading day, markets were up considerably. Much of the gains were eroded after 2 pm. Housing starts jumped, indicating the real estate market is still healthy. This news alone, though, was not enough to keep things bolstered. The NASDAQ and the broader S&P 500 ended slightly down, not enough to even note. The Dow managed a decent gain of over 32 points. It's quiet in the office today, and this seems to be the same on Wall Street.

Dow +32.73

NASDAQ -3.36

S&P 500 -0.02

Monday, June 19, 2006

See Saw Monday

Well, we're back in the red. Oil prices are still dropping. Merger activity is heating up, but Wall Street is still skittish. After a couple of stellar days, the market pulled back. Nokia and Siemens announced their "marriage," which should make the combination a powerhouse in the wireless equipment arena. I guess you could explain the swoon by recognizing that it's a hot, lazy Monday.

Dow -72.44

NASDAQ -19.53

S&P 500 -11.40

Friday, June 16, 2006

Retirement for the Big Guy

The long-time richest man in the world announced his two-year plan to step down as Microsoft's chief software architect. Bill Gates will remain as the company's chairman, but wants to start a daily routine at his non-profit foundation. Along with this, Microsoft announced today a practice of backdating options was used in the 1990's. These two announcements, although not negatively affecting Microsoft stock, had a slightly negative effect on the market.

Trading slightly dwindled today as investors weighed Microsoft's news and Oracle's earnings pre-announcement. In the last hour of trading, the Dow went from 8 points up to less than a point down. But with the weekend approaching and the market much more stable, I can't wait to test my new hammock!

DJIA: -0.64

Nasdaq: -14.20

S&P 500: -4.62

Thursday, June 15, 2006

TWO days in a ROW!

Wall Street has come back with a bang. Mr. Bernanke spoke today and kept it a bit tamer than before. He still has some concerns, but he played these down. I think he may be getting the hang of this thing! Large-caps gained about 2% on the day, while techs racked up almost 3%. It was a welcome relief after the last few weeks. There was no big news to create this rally. It appeared that investors saw the dip as an opportunity. I can hardly contain myself on a day like this. I'm dancing. I'm singing. Of course, I keep reminding myself... this is just the nature of the stock market. If you're still a little hesitant about stocks, check out this list of mutual funds. There are several on the list that we use. It's a way to be in the market without losing sleep.

DJ 30 +197.55 +1.83%

NASDAQ +58.15 +2.79%

S&P 500 +26.07 +2.12%

Wednesday, June 14, 2006

Rally on Three! Rally on Three! Rally, Rally....

Wall Street was saved from its negative innings today by a last-hour rally. Despite the higher-than-expected consumer report, the Dow rose more than 100 points to 10816.92. After several days of a last-hour downward slope, the opposite was true today. Much of the gain was due to Boeing, climbing 6.5% after being upgraded to "inline" from "underperform" by Goldman Sachs. Intel and Microsoft were also both up, with market analysts calling today a "stable" day. I'm glad - we could use a little stability right now!

DJIA: +110.78

Nasdaq: +13.53

S&P 500: +6.35

Tuesday, June 13, 2006

Another Day...

Markets started off in positive territory but gave up those gains (and then some) by the end of the day. While talk of inflation appears to be the culprit, the very things that are spurring the talk are getting hit. High-flying gold prices dropped by $30 today, while oil fell below $70 a barrel. Normally, that's good news. But, today, investors are still skittish. If we can get past the next Fed meeting and this proposed rate hike, things should calm down a bit. Meanwhile, I'm in the buying crowd. If you're fully invested, now is the time to keep your head down and stay the course. We're not through the turbulence yet.

DJ 30 -86.44

NASDAQ -18.85

S&P 500 -12.72

Monday, June 12, 2006

Warning: Use Caution

Investors are using much caution in these last days before the release of some very crucial reports that could determine whether or not we are, in fact, in a period of inflation. The name of the game on Wall Street today was "risk-aversion." The hope is that data from these soon-to-be-released reports (the wholesale price inflation data and the May consumer inflation results) will be much tamer than expected, and a large rates increase won't be necessary. We're keeping our fingers AND toes crossed.

And despite the nervous activity in the market, the Lehman Brothers reported their second-best quarter yet, and GM was up 1.7% amid talks between their supplier and the United Auto Workers.

DJIA: -99.34

Nasdaq: -43.74

S&P 500: -15.90

Investors are using much caution in these last days before the release of some very crucial reports that could determine whether or not we are, in fact, in a period of inflation. The name of the game on Wall Street today was "risk-aversion." The hope is that data from these soon-to-be-released reports (the wholesale price inflation data and the May consumer inflation results) will be much tamer than expected, and a large rates increase won't be necessary. We're keeping our fingers AND toes crossed.

And despite the nervous activity in the market, the Lehman Brothers reported their second-best quarter yet, and GM was up 1.7% amid talks between their supplier and the United Auto Workers.

DJIA: -99.34

Nasdaq: -43.74

S&P 500: -15.90

Friday, June 09, 2006

Wall Street Theme Park

I'm usually already relaxing for the weekend by the time the market closes on Fridays. But this Friday, I feel as though I've spent the entire week at Disney World doing nothing but jumping from rollercoaster to rollercoaster! The market has seemingly gone tospy-turvy this week, and I'm feeling the fatigue of trying to keep up.

Thankfully, there is knowledge that relieves our worry and fatigue like a tall Donald Duck-shaped cup of lemonade between rides. Knowledge like the upcoming inevitable fourth-quater rally that usually follows midterm elections. Knowledge that most analysts expect stocks to stabilize in the next few weeks, not plummet. And of course, there are the numbers. Numbers like 1.5 - the percentage that the Dow Jones World Stock Index was up this week. And the number 4.99, the slowly increasing but still very low short-term interest rate. Ahhh, the relief of knowledge.

So its home I go on this long-awaited Friday afternoon. Home to watch the World Cup. Home to make some sweet, ice-cold lemonade.

DJIA: -46.90

Nasdaq: -10.26

S&P 500: -5.63

Tuesday, June 06, 2006

Pink Ink

Yesterday was definitely a red ink day as markets plunged on comments from the Fed Chief. Today, another Fed board member backed him up, indicating they may be ready to hike rates again. While the market responded negatively, the result was not quite so, well, red. I call it Pink Ink. The Dow managed to stay above 11,000, when all was said and done. The numbers were all negative, but the slide has slowed. In the midst of the decline, GM reassured investors about its progress. The auto giant is tackling its problems and making headway. This came on the same day that Moody's is threatening to downgrade Ford bonds even more. What a topsy turvy day... Pink Ink!

DJ 30 -46.58

NASDAQ -6.84

S&P 500 -1.44

Monday, June 05, 2006

Monday Inflation Jitters

Ben Bernanke spoke, and Wall Street didn't like what it heard. The inflation word surfaced again today, and investors ran for the doors. Large-caps dropped about 1 3/4%, while NASDAQ gave up over 2% on the day. I think this novice needs to learn to keep his mouth shut! Prices (namely in the real estate and fuel sectors) have definitely risen, but is this enough to slow down business? Interest rates are still at historically low levels, so if the Fed decides to announce another bump up, the effects should not be too dampening. C'mon, Ben. Easy with the inflation talk. We want the good times to keep on rolling.

DJ 30 -199.15 -1.77%

NASDAQ -49.79 -2.24%

S&P 500 -22.93 -1.78%

Friday, June 02, 2006

Flat Friday

So, when is not so good news actually good?

With all the anxiety about inflation and its impact on the economy, a tepid jobs report served to calm things down. Normally, we like to see new jobs numbers in the 150,000 range. Today, they were reported at only 75,000. So, maybe inflation is not lurking around the corner. After all, we want growth, but we don't want runaway growth. That kind can't be sustained for long. Today's numbers left the market feeling calm and, mainly, flat. The Dow and the NASDAQ dropped slightly, while the S&P actually gained on the day. Still, pretty flat, but right now, flat beats the roller coaster.

Dow -12.41

NASDAQ -0.45

S&P 500 +2.51

Thursday, June 01, 2006

My Two Cents

A penny just doesn't buy anything anymore. Seems it costs more to make these coins than what they are worth in the store. Congressman Jim Kolbe has plans to eliminate the little one cent wonders. No more finding lucky pennies while strolling along. No more friendly little cups in convenience stores for those extra donated pennies. Pennies are just "feel good" coins. Ahh, it makes me sad.

But Wall Street cheered me up today. NASDAQ added almost 2%, while large-caps put in healthy numbers, as well. Keeping up with investor sentiment these days is like watching a tennis match. Speaking of which... I'm upset that I have to get up a 4 am just to catch some of my favorite sport. The French Open is in full swing, but ESPN is not taking note. I guess it's another sign that I'm out of fashion!

Dow +91.97

NASDAQ +40.98

S&P 500 +15.62

A penny just doesn't buy anything anymore. Seems it costs more to make these coins than what they are worth in the store. Congressman Jim Kolbe has plans to eliminate the little one cent wonders. No more finding lucky pennies while strolling along. No more friendly little cups in convenience stores for those extra donated pennies. Pennies are just "feel good" coins. Ahh, it makes me sad.

But Wall Street cheered me up today. NASDAQ added almost 2%, while large-caps put in healthy numbers, as well. Keeping up with investor sentiment these days is like watching a tennis match. Speaking of which... I'm upset that I have to get up a 4 am just to catch some of my favorite sport. The French Open is in full swing, but ESPN is not taking note. I guess it's another sign that I'm out of fashion!

Dow +91.97

NASDAQ +40.98

S&P 500 +15.62

Subscribe to:

Comments (Atom)